Would Student Loan Forgiveness Help Young Homebuyers? Not Necessarily

[ad_1]

This year, as the economy has increasingly looked like it’s in trouble and as the midterm elections draw nearer, the Biden administration has zeroed in on a novel policy idea: Forgive some student loan debt.

The idea behind this proposal is fairly simple: Americans are being squeezed financially on many fronts, and because student loans are backed by the federal government, Biden could theoretically wipe out those debts with an executive order.

Forgiving student loan debt would have lots of economic impacts, but one of the most common arguments in the debate over this policy is that it would influence the housing market. Especially among younger Americans, the logic goes, massive student loan debt has made it more difficult to get into the real estate market. Wipe out that debt, and more people get to buy houses.

There’s some truth to this, and economists who spoke to Inman said debt forgiveness could be a huge boon to large numbers of would-be homeowners. However at the same time, there are a lot of other things making the housing market tough right now, and forgiving debt is ultimately unlikely to fundamentally change that reality.

Biden hasn’t unveiled his specific policy yet, but here’s what you need to know as the country waits for the president’s decision:

How big a deal is student loan debt?

The latest figures put the number of Americans who currently have student loans at just north of 43 million. That’s a huge number in absolute terms. Among Americans between the ages of 18 and 29, 34 percent have some student debt.

In total, Americans owe more than $1.7 trillion in student loans, about $1.6 trillion of which are federal loans and thus subject to forgiveness from Biden. The average amount owed is just over $37,000, according to the Education Data Initiative (EDI).

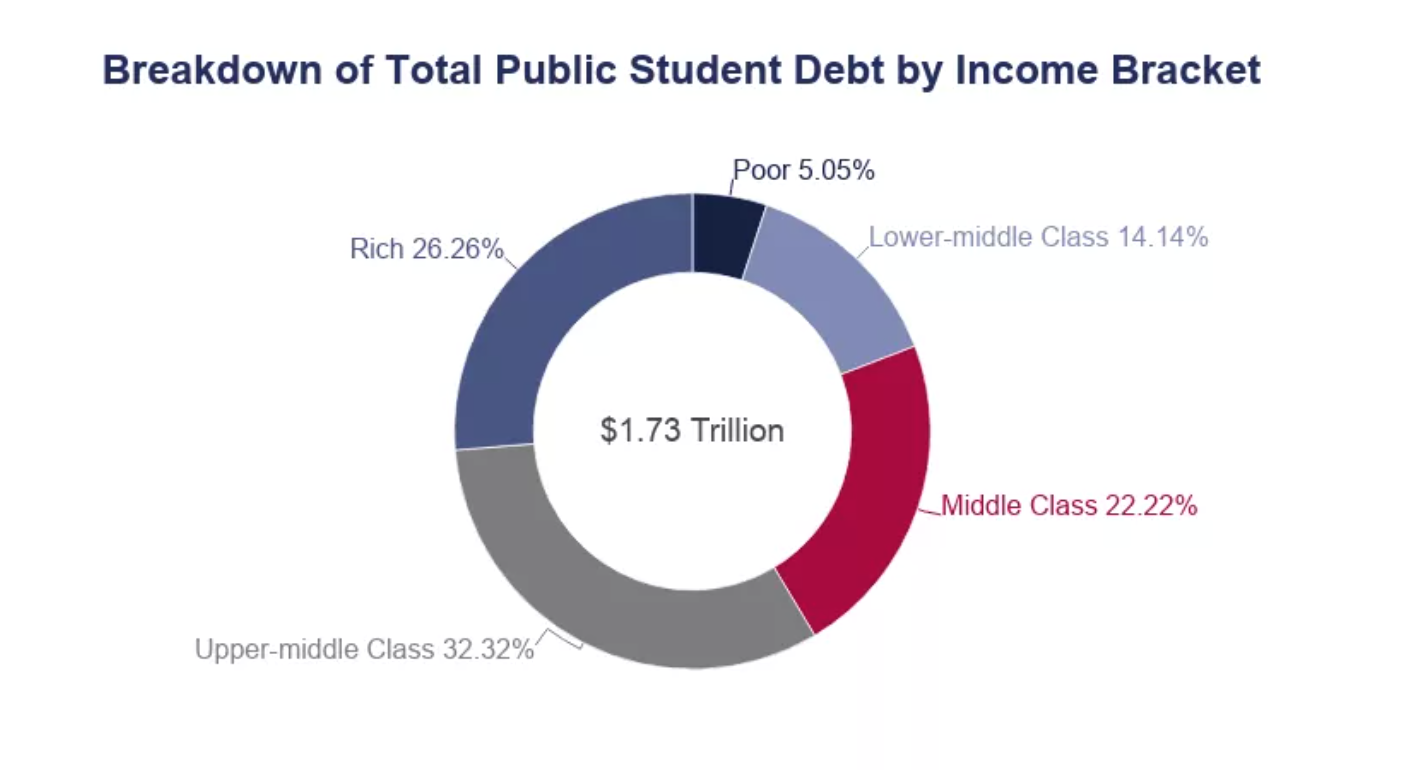

An EDI report further reveals that a majority of student loan “debt is located with those households in the higher income brackets.” Specifically, 60 percent of the debt is held by households making more than $74,000 per year. More than a quarter of the debt, or 26.6 percent, is held by households in the 99th percentile for income, which the report classifies as “rich.” Another third of the debt is concentrated among households that the report classifies as “upper middle class.”

Credit: Education Data Initiative

The report also reveals that, unsurprisingly, average debt increases as people get more degrees. For example, the average amount of debt for people with an associate’s degree is $19,600. But for people with with a doctorate, the average is $117,146.

The picture that emerges from all of this data is that student loan debt is a huge issue in the U.S., but that it’s impacts are not evenly distributed.

So what does all this mean for housing?

Setting aside the issue of whether or not debt should be forgiven, economists believe that student loans are impacting some Americans’ ability to buy a house. Matthew Gardner, the chief economist for Windermere Real Estate, told Inman that while the U.S. population may be north of 330 million, meaning only about 13 percent have student loan debt, the number of people over the age of 22 — an age at which a person might first start consider buying a home — is around 237 million. And the number of Americans between the ages of 23 and 31 is just over 40 million.

Matthew Gardner

The point is that millennials and Generation Z are smaller subsets of the overall population. They’re also in or entering prime homebuyer years. And they tend to carry more student debt than older generations, meaning student loan debt is having an impact on their ability to purchase a house. Gardner said that student debt isn’t the only thing impeding younger buyers; he said that combined with factors such as rising rents, it is indeed contributing to an environment that is making it harder to begin climbing the real estate ladder.

“It certainly is going to add angst to first-time homebuyers, who it’s going to impact most,” Gardner said. “The bottom line is it’s certainly not going to stop the world from moving forward, but it is another impediment for that demographic.”

George Ratiu

George Ratiu, senior economist for Realtor.com, made a similar point, noting that “for a lot of Americans, student debt adds another burden to the monthly financial load.” Other expenses adding to that burden include existing housing costs, insurance and more recently, rising inflation. But when the ledgers are all done, student debt can be the (big) straw that breaks the camel’s back and knocks a consumer out of the homebuying market.

“It means that in aggregate, you throw all these together in a blender and what you have is a monthly financial burden that may very well put homeownership out of reach,” Ratiu told Inman.

A report from Zillow further breaks down this issue, stating that “student debt risks putting many would-be homebuyers — particularly buyers of color — very close to or over conventional debt-to-income ratios, disqualifying them from homeownership even before they’ve applied for a mortgage.” This is similar to the point Ratiu and Gardner were making, where student loan debt adds to a would-be buyer’s overall burden.

The picture that emerges here is that while student loan debt impacts a relatively small minority of Americans, it looms especially large in the housing industry. That’s because younger adults are both more likely to hold student debt and to be in the demographic where they might be buying their first home. The EDI report summed up the ultimate impacts:

“Fifty-three percent of millennials have not bought a home because student loan debt either disqualified them or made it impossible to afford a mortgage,” the report states.

What is Biden actually proposing and will it matter for housing?

So far, the Biden administration hasn’t announced a specific policy. However, while campaigning for president, Biden did float the idea of forgiving $10,000 in student loan debt. The issue largely fell onto the back burner over the ensuing two years as Biden focused on other policy issues, but on April 28 he confirmed that he was now “considering dealing with some debt reduction.” At the time, Biden also said he was “not considering [a] $50,000 debt reduction,” according to CNN.

As a result of that remark, most commentators seem to believe Biden’s debt forgiveness proposal will involve erasing either $10,000 as he originally proposed, or maybe some amount between $10,000 and $50,000.

Other reports have suggested Biden is considering income-based limits on who qualifies for forgiveness. The limits could be between $125,000 and $150,000 for people who file their taxes individually, or between $250,000 and $300,000 for couples who file jointly, according to The Washington Post.

None of these ideas are set in stone yet, but offer a sneak peak at Biden’s thinking on the issue. Concrete details are expected in the coming weeks.

Assuming a policy does materialize, it will have impact on two levels: At the individual level and as a systemic force that sways the housing market as a whole.

To the first point, there’s no question debt forgiveness of any kind would be helpful to many individuals. Zillow’s report, for example, notes that “a $10,000 reduction in the typical student loan burden could potentially allow about 1 million likely student borrowers (those on a standard 10-year repayment track) to more comfortably afford a monthly mortgage payment.

“An additional 171,000 likely student borrowers on an income-based repayment plan could also move within reach of affording homeownership under this scenario,” the report states.

Ratiu concurred, saying that, “Yes, some degree of student debt forgiveness would improve in the short term the financials of a lot of borrowers.”

However, as a force for reshaping the entire housing market — for example by allowing millennials en masse to become homebuyers — debt forgiveness would likely have much more limited impacts. Ratiu noted that constraints such as rising mortgage rates, inflation and a lack of inventory would all still exist in that world, and would continue making it hard, especially for younger buyers, to get a home.

“We really need more construction,” he said. “More inventory.”

Who supports and opposes student loan forgiveness?

The proponents

The biggest and most significant proponent of student loan debt forgiveness is, obviously, Biden. However, a number of more liberal Democrats have also called for the federal government to take action. In January, Sen. Elizabeth Warren proposed forgiving $50,000 in debt. Biden has ruled out that sum, but the proposal was in line with Warren’s past stance where she has been on the vanguard of this issue. The $50,000 number is also significant because it exceeds the average amount debtors owe — meaning it would entirely wipe out loans for a large number of people.

Rep. Alexandria Ocasio-Cortez also supports debt forgiveness. Late last month she told The Washington Post that “canceling $50,000 in debt is where you really make a dent in inequality and the racial wealth gap. $10,000 isn’t.” Ocasio-Cortez also told the paper that she doesn’t “believe in a cutoff,” suggesting she’d be open to an even more expansive forgiveness policy.

Other prominent members of the Democratic coalition, such as Senators Chuck Schumer and Bernie Sanders, have also voiced support for varying degrees of debt forgiveness.

The critics

While loan forgiveness is currently a proposal from Democrats, Republicans have been criticizing it. Last month Sen. Mitt Romney referred to debt forgiveness as “desperate measures” and a “bribe.” Sen. Tom Cotton and Representatives Virginia Foxx and Jason Smith, along with many other Republicans, have also criticized the concept of erasing student loans.

But this potential policy has also created some strange bedfellows.

Just days ago, The New York Times ran a piece urging Democrats to show restraint on the issue lest voters punish them at the polls. In recent week, multiple pieces have appeared in The Atlantic that were critical of debt forgiveness, and a January report from the Brookings Institute argued that student loan debt forgiveness is actually regressive and a “a costly and ineffective way to reduce economic gaps by race or socioeconomic status.”

What’s significant about all of that commentary is that it’s coming from the left-leaning political center, not the right. Which is to say that if we were to oversimplify, progressives are tending to support major debt forgiveness initiatives, while conservatives and moderates are tending to oppose them, or at least call for significant moderation.

When it comes to housing and real estate, the exact contours of the political battle are probably only useful for understanding how likely a policy is to materialize, and how aggressive it’s going to be. Indeed, the fact that many observers expect Biden to forgive $10,000 in debt suggests he’ll probably try to split the political difference between the progressive and moderate wings of his party.

Whatever happens, the economists who spoke with Inman said debt forgiveness is unlikely to fundamentally change the equation for the U.S. housing industry. And there are pros and cons to that reality. On the one hand, debt forgiveness isn’t likely to introduce chaos into the world of real estate. But on the other hand, it means younger buyers and the agents who work with them will continue to face a housing landscape that looks ever-more hostile.

“The bottom line is that this is a big thing,” Gardner said. “Is it enough to shift the market? I don’t believe that it is. However it’s just adding on to a situation in which these younger would-be homebuyers are faced with all these obstacles.”

Email Jim Dalrymple II

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)