Haverty Furniture Carves Financial Stability (NYSE:HVT)

[ad_1]

itchySan/E+ via Getty Images

Haverty Furniture Companies, Inc. (NYSE:HVT) remains unfazed despite the pandemic. Supply chain disruptions and inflationary pressures are challenges to the core operations. But, the stability as shown by its revenues and costs and expenses are evident. The Balance Sheet shows liquidity, proving the financial consistency. Hence, the company has ample resources to increase its operating capacity.

But, the stock price does not seem to go along with the fundamentals. It has been moving downwards for almost a year now. The good thing about it is that the price is low, so there is much room for gain. Meanwhile, dividend payments are consistent since the company can cover and raise them. The yield is pretty decent, so considering it an undervalued stock is reasonable.

Company Performance

Haverty Furniture Companies, Inc. started operating as a small retail furniture company in 1885. It had a single store in Atlanta, Georgia, before expanding. Over the years, it has grown and emerged as one of the top furniture companies in the US. Today it has over 100 stores in different locations. Its stores are company-owned, and it does not franchise any of them. This model slows down margin expansion. But, it provides the company with more control over the operations and products to sell. So, it has a better user experience, allowing it to adjust its operations when necessary.

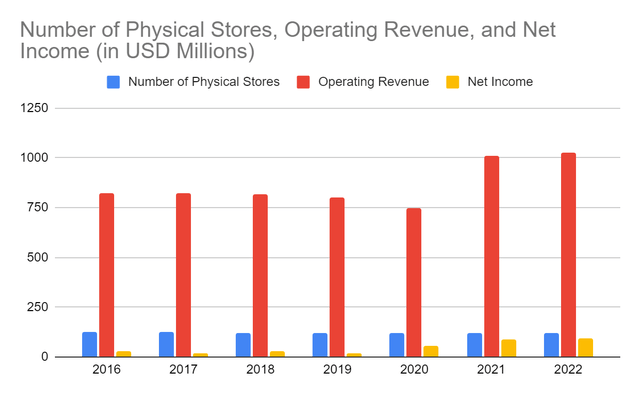

In recent years, the company has struggled to grow its core operations. For a better view, we can see the trend of the operating revenue here. It had to close some stores, which decreased store count from 124 to 120. The move proved efficient as margins and net income became more stable. Only, there have been no considerable changes. But in 2020, the contraction proved fruitful as costs and expenses became manageable. Net income exceeded the usual range, almost twice as much as the average.

Since 2021, the resurgence has become more evident. The number of stores did not change much at 121. Thanks to the upsurge in demand matched with the strategic pricing, there was substantial year-over-year growth in all quarters. The robust trend did not last long. Nevertheless, the operations are now more stable.

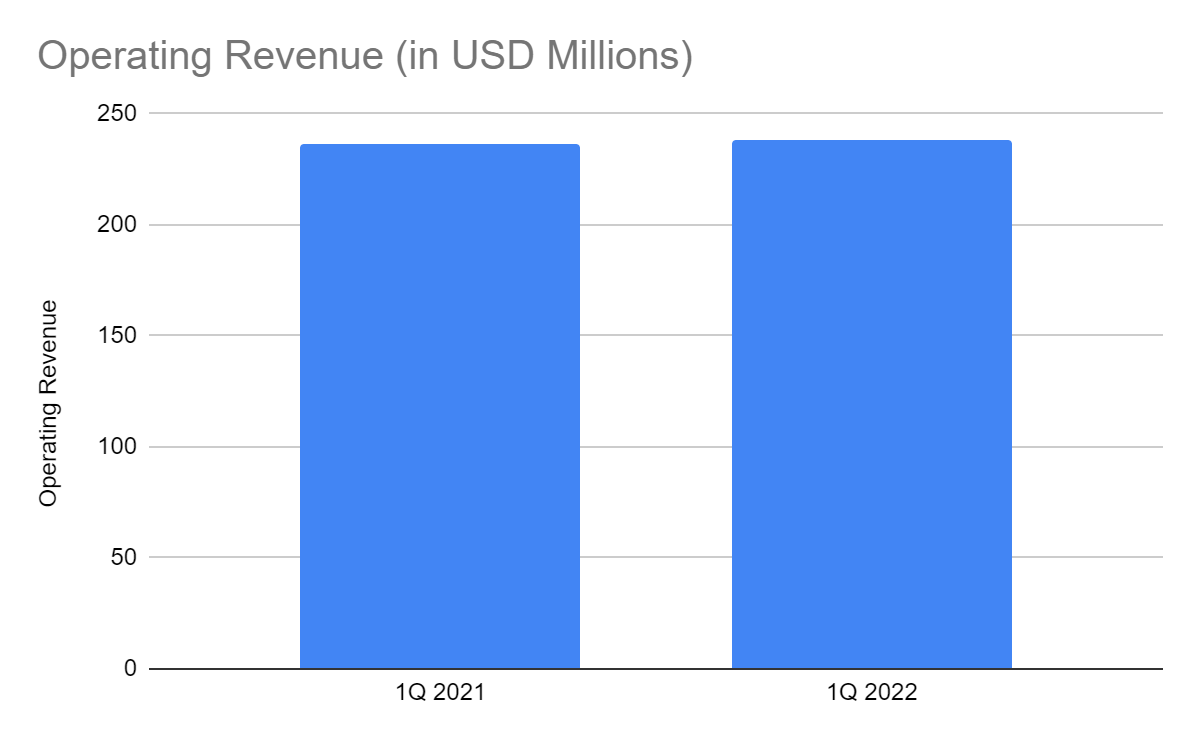

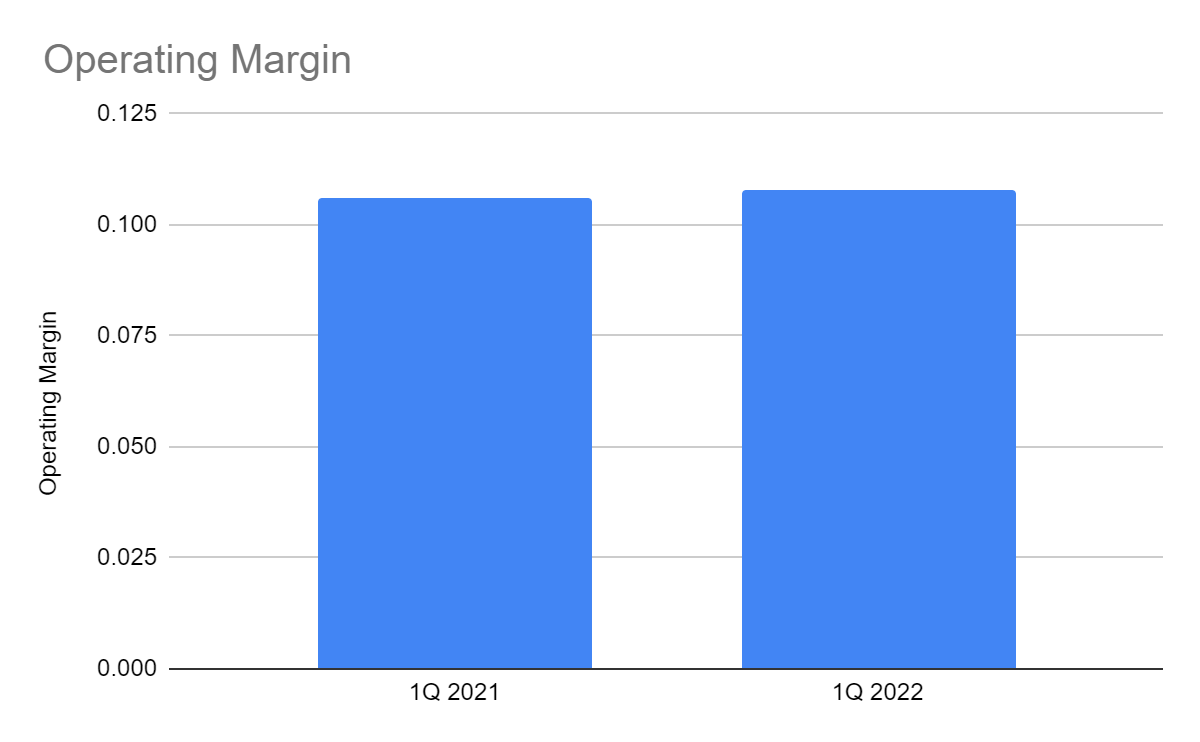

Today, Haverty sees an uptrend in sales and operations, although it is not as much as in 2021. The operating revenue in 1Q 2022 is $238 million, a 1% year-over-year growth. The operating margin is 8% versus 10.6% in the comparative quarter. Indeed, growth seemed to slow down this year. But, it is worth noting that supply chain disruptions are evident. They continue to cause delays in the delivery of goods in the stores. In addition, inflationary pressures are much higher, which affects the purchasing power of customers.

Operating Revenue (MarketWatch)

Operating Margin (MarketWatch)

Fortunately, Haverty continues to maneuver its business with ease and prudence. It adjusts its prices in line with inflation. The changes may cover rising costs, offset delays, and boost store traffic. Also, they are still reasonable enough not to hurt the purchasing power of customers. The thing is, the struggles that the company has been through made it extra prepared for these. It remains resilient with its competitive pricing and financial stability.

The supply chain disruptions may persist but may be more manageable in the second half. Also, more people may be able to adjust to price changes. These may be in line with the easing of restrictions and improvement in the labor market. So, its plan to open four more stores will be timely to enhance its performance further. In the graph below, we can see how store openings and closures helped with its resurgence.

Number of Physical Stores, Operating Revenue, and Net Income (MarketWatch)

Moreover, its plan to increase spending on information technology may be a giant leap. It may help increase its online presence and capture more demand. It is a sagacious move as more customers are shifting to the internet. Also, online transactions through VCCs and e-wallets are more popular today. The enhanced digital capabilities may help Haverty cope with the challenges and rebound.

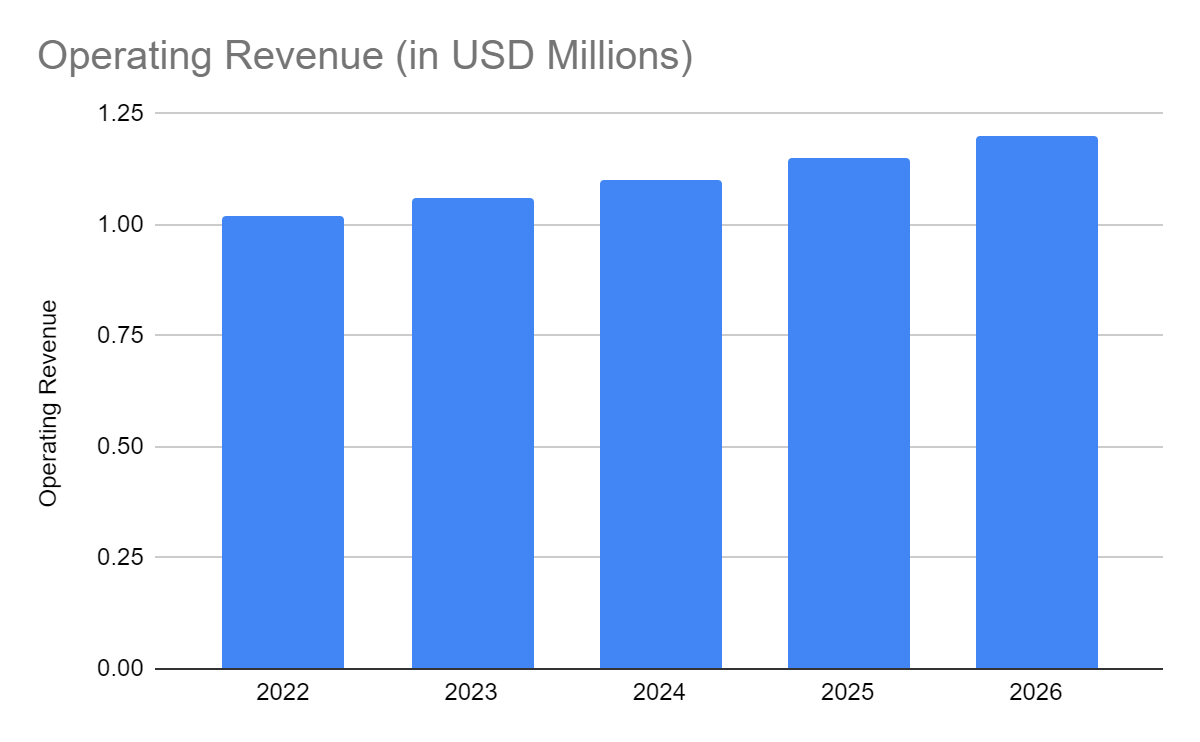

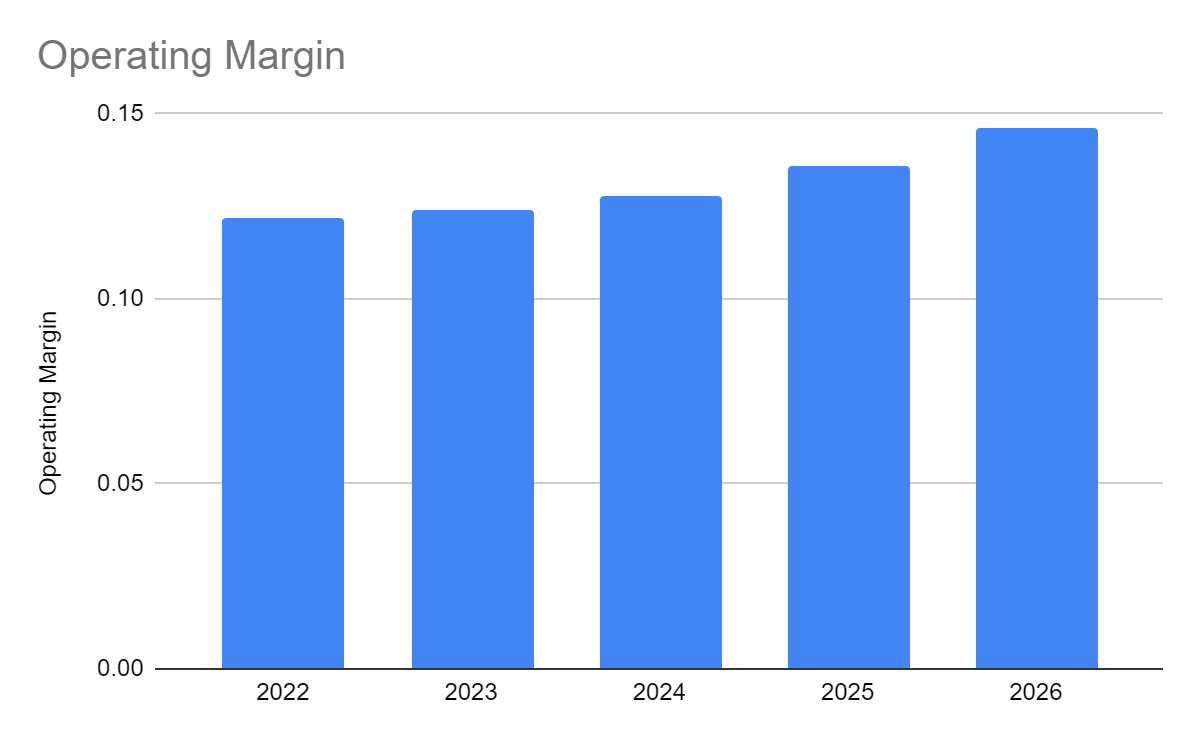

I thus project its operating revenue to increase. But with external pressures, the increase may not be substantial. It may only amount to $1.02 billion with an operating margin of 12.2%. For the next few years, revenues may speed up to $1.06-1.20 billion. Likewise, the operating margin may reach 12-14%.

Operating Revenue (Author Estimation)

Operating Margin (Author Estimation)

Stable Balance Sheet

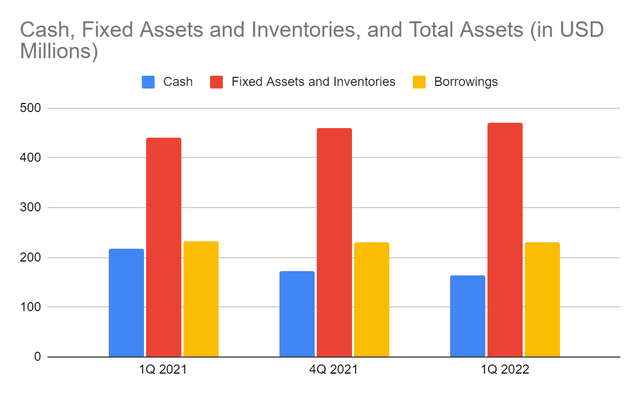

The Balance Sheet proves the financial stability of Haverty. Despite the gradual growth amidst external pressures, operations remain manageable. There is a notable decrease in cash and cash equivalents to $164 million. But, the fixed assets and inventories are increasing. It shows the increased operating capacity of the company. The expansion is feasible since the company has enough means to sustain it. Cash and cash equivalents comprise 24% of the total assets, making the company liquid.

Another factor to consider is its stable borrowings. From $231 million in 1Q 2021, the proportion of cash to borrowings is lower. But, we may infer that the expansion comes mainly from cash. It does not increase its financial leverage to sustain its rising production level. Hence, it may increase its operating capacity while covering payables. The stability may also show the consistency between profitability and sustainability.

Cash, Fixed Assets and Inventories, and Total Assets (MarketWatch)

Price Assessment

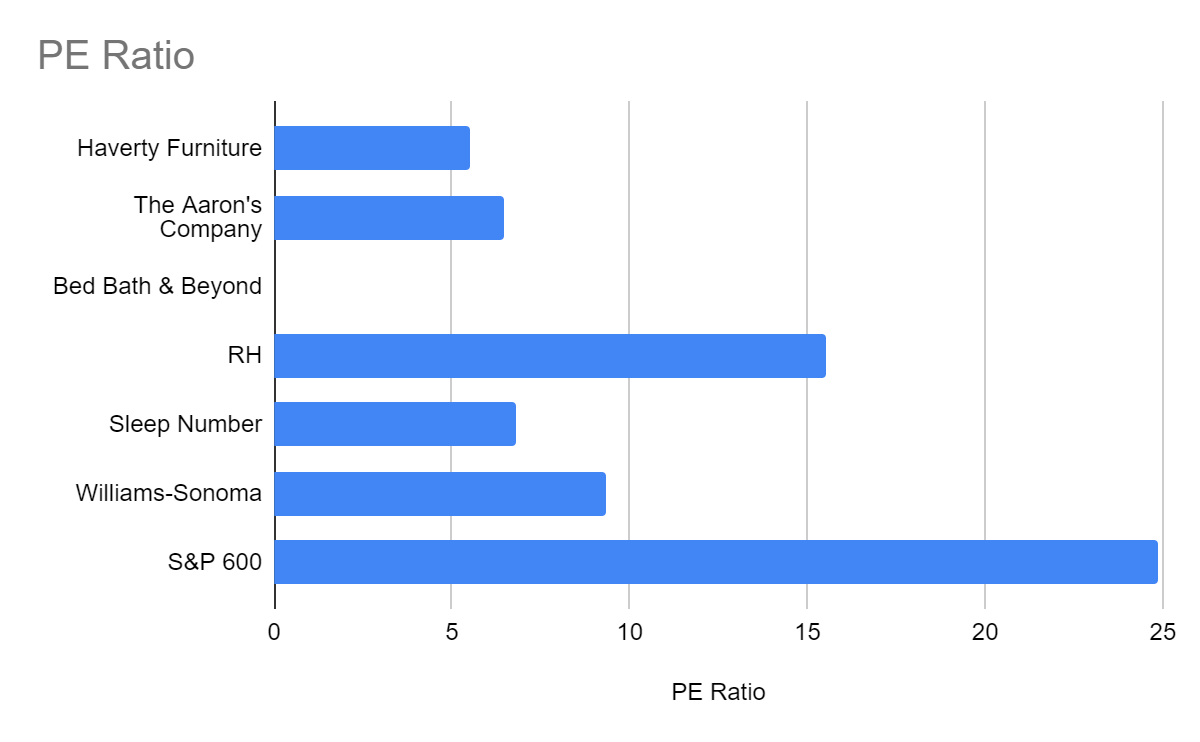

The stock price of HVT has been moving downwards for a year now. The downward pattern remains undisturbed despite the impressive fundamentals. Today, the downtrend persists even after the release of the 1Q 2022 financial report. It is logical since there have been no massive changes in the financials. But what is visible is its exceptional cheapness. At $26.99, the price is still low, with a PE Ratio of 5.51, making it undervalued. Also, it is lower than many of its peers, making it one of the most potentially profitable stocks. We may estimate the price better using the DCF Model.

PE Ratio (Yahoo Finance)

|

FCFF |

$24,000,000 |

|

Cash and Equivalents |

$164,000,000 |

|

Outstanding Borrowings |

$100,000,000 |

|

Perpetual Growth |

4.80% |

|

WACC |

8.40% |

|

Common Shares Outstanding |

29,900,000 |

|

Stock Price |

$26.99 |

|

Derived Value |

$38.87 |

Given the derived value of $38.87, the stock price appears to be undervalued. Note that the company has no outstanding borrowings as of 2021. I assume it will increase to $100 million for a more conservative estimation. There may be an upside of 44% for the next 12-24 months. Hence, the stock price seems cheap.

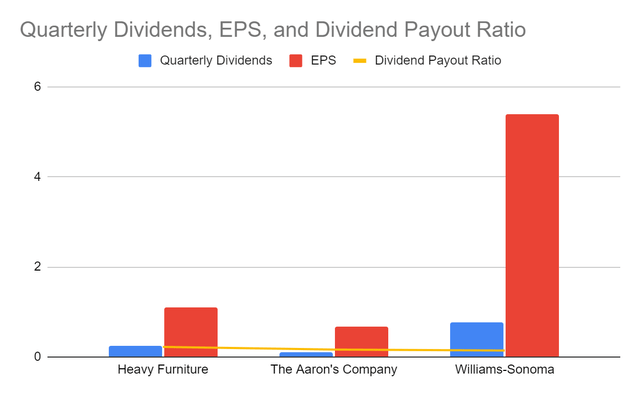

The dividends are also a factor to consider. With $0.25, the annualized value is $1.00 without special dividends. It has an attractive dividend yield of 3.7%. But, what makes it attractive is its adequate capacity to sustain dividends. The Dividend Payout Ratio is 24%, giving ample room to cover its financial leverage and expand. We may also assess the price using the Dividend Discount Model.

Quarterly Dividends, EPS, and Dividend Payout Ratio (Yahoo Finance)

|

Stock Price |

$26.99 |

|

Average Dividend Growth |

0.1778119541 |

|

Estimated Dividends Per Share |

$1.00 |

|

Cost of Capital Equity |

0.2164518305 |

|

Derived Value |

$38.48177337 or $38.48 |

The derived value also shows the undervaluation of the stock price. Note that I only used regular dividend payouts for a more conservative estimation. The agreement between the models may project a potential stock price upside.

Bottom Line

Haverty Furniture Companies, Inc. continues to show stable fundamentals amidst external pressures. Revenue growth and margin expansion may not be robust. But, profitability and liquidity show sustainability. Meanwhile, the stock price appears to be cheap with a potential upside. The optimal move for now is that HVT is a buy.

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)