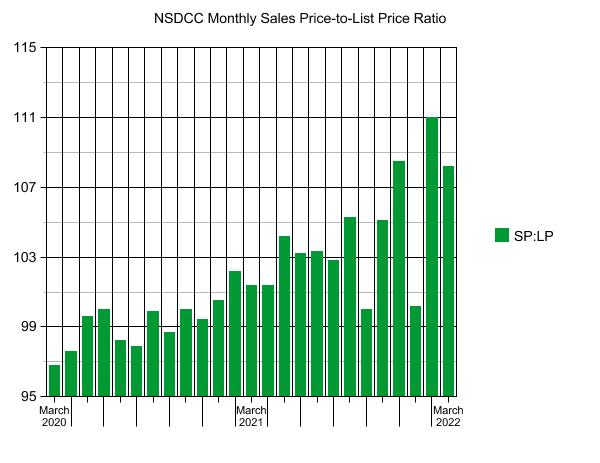

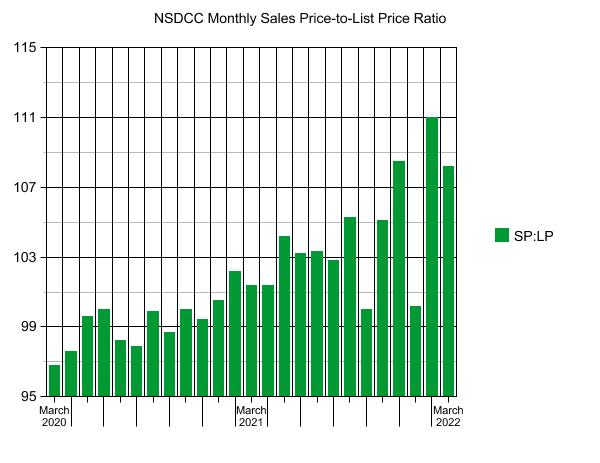

Let’s take a look at the covid history of one of our frenzy measuring sticks:

NSDCC Sales-Price-to-List-Price Ratio:

| Month |

# of Sales |

Median List Price |

Median Sales Price |

SP:LP Ratio |

| March 2020 |

206 |

$1,492,500 |

$1,445,000 |

96.8% |

| Apr |

156 |

$1,424,499 |

$1,390,000 |

97.6% |

| May |

143 |

$1,399,900 |

$1,395,000 |

99.6% |

| Jun |

274 |

$1,362,500 |

$1,363,700 |

100% |

| Jul |

351 |

$1,450,000 |

$1,423,350 |

98.2% |

| Aug |

350 |

$1,450,000 |

$1,419,812 |

97.9% |

| Sep |

360 |

$1,500,000 |

$1,498,750 |

99.9% |

| Oct |

382 |

$1,696,500 |

$1,674,100 |

98.7% |

| Nov |

305 |

$1,599,000 |

$1,599,900 |

100% |

| Dec |

290 |

$1,633,500 |

$1,624,391 |

99.4% |

| Jan |

187 |

$1,716,690 |

$1,725,000 |

100.5% |

| Feb |

224 |

$1,719,500 |

$1,758,000 |

102.2% |

| March 2021 |

252 |

$1,800,000 |

$1,825,000 |

101.4% |

| Apr |

359 |

$1,799,900 |

$1,825,829 |

101.4% |

| May |

300 |

$1,900,000 |

$1,979,500 |

104.2% |

| Jun |

357 |

$1,900,000 |

$1,960,000 |

103.2% |

| Jul |

312 |

$1,792,500 |

$1,852,500 |

103.3% |

| Aug |

268 |

$1,897,000 |

$1,950,000 |

102.8% |

| Sep |

283 |

$1,899,000 |

$2,000,000 |

105.3% |

| Oct |

251 |

$1,899,000 |

$1,899,000 |

100% |

| Nov |

200 |

$1,998,500 |

$2,100,000 |

105.1% |

| Dec |

183 |

$1,995,000 |

$2,165,000 |

108.5% |

| Jan |

140 |

$2,234,944 |

$2,240,000 |

100.2% |

| Feb |

158 |

$2,149,500 |

$2,386,500 |

111.0% |

| March 2022 |

206 |

$2,425,000 |

$2,625,000 |

108.2% |

The chatter increases with the lower volume, plus there are going to be months when the offerings just aren’t that tasty. But in 2022, when buyers see a home they like, they over bid substantially!

All we have to do is watch the trend over the next few months to know the direction of the market.

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)