Construction Jobs and Spending Briefs 4-1-22 « Construction Analytics

[ad_1]

Construction Jobs report for Mar 2022 shows total jobs up 19,000 from Feb

Rsdn jobs +7,600, Nonres Bldgs +6,300, Civil +5,000

Although construction jobs increased by 19,000 in March, total hours worked dropped by 1.8% from Feb, so total workforce output is down.

It’s real hard to compare construction jobs growth by sector. If you work for a concrete firm or structural steel firm, with firm doing primarily nonresidential work, but you are out there putting in concrete or steel for a high-rise multifamily buildings, your job is still classified as nonresidential.

Jobs are up 82,000 year-to-date, 1.1% from Dec, but that’s also up 3.5% from ytd 2021. With the latest quarter at +1.1%, jobs are increasing at a rate of 4%/year. But inflation adjusted spending, building activity, is expected up only 2.5% in 2022, after dropping -2% in 2021. Jobs increased 2.5% in 2021.

2022 spending started the year at the highpoint. I expect a slow decline in monthly spending in all sectors of 2% over the 2nd half. That provides no support for jobs growth.

Construction jobs have nearly returned to pre-pandemic levels. The problem with construction jobs having returned to pre-pandemic levels is the level of inflation adjusted construction volume of activity that is needed to support those jobs is still 5% below Feb 2020 and 13% below the 2006 peak. So since Feb 2020, jobs are back to that level, but volume is not so productivity has dropped by 5%.

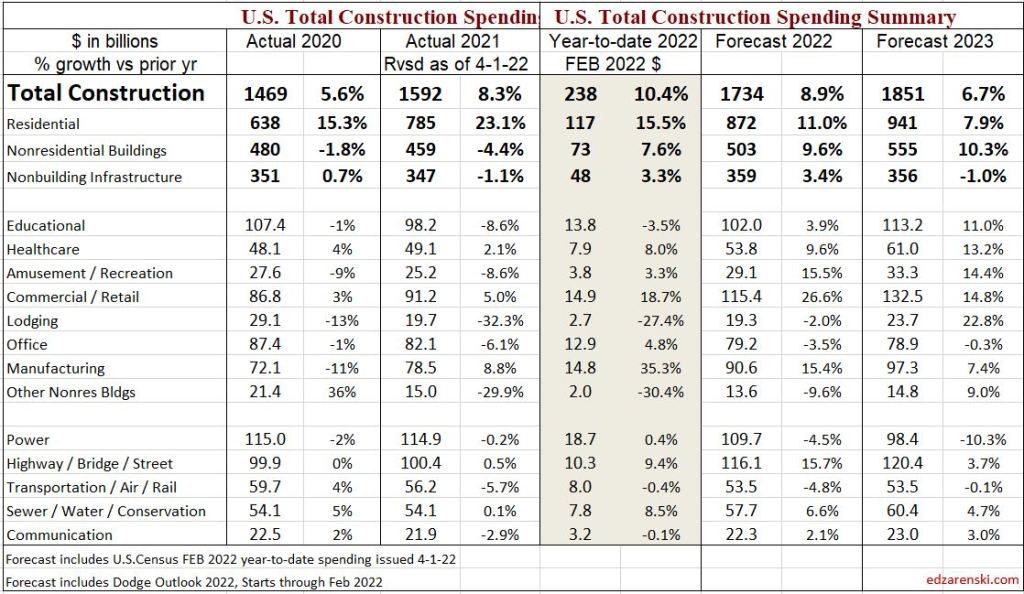

Construction Spending is up +10.4% year-to-date (in 2 months!) mostly driven by +15.5% ytd Residential.

A plot of residential construction spending inflation adjusted. Taking out inflation shows volume of building activity. Perhaps the trend in residential is strong enough to keep going.

Total spending is up +4% in 3mo since Nov 2021 (and 10% ytd-2mo), but I don’t expect this rate of growth to hold. However, this and any other changed data inputs revises my 2022 spending forecast.

Examples of big changes since initial forecast:

Manufacturing spending has increased so much in Jan-Feb, (up 35% ytd) that even if the next 10 months finish flat year/year, Mnfg will still finish up 5% for 2022.

Residential new starts for the latest 3 mo, Dec-Jan-Feb, avg is as high as any quarter last year. Nearly all of this spending occurs in 2022.

Construction buildings cost inflation over the last 4 years is up 25%. Labor cost, wages up 15% & productivity down 7%, is up 22%. But labor is 35% of total building cost so 22% x 35% = labor is 8% of that total 25% building cost inflation. Fully 1/3 of construction inflation over last 4 years went into workers pockets.

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)