Who Profits Most From Unaffordable Housing?

[ad_1]

Those of you who are not currently working in the real estate industry probably aren’t familiar with the publication, “Real Estate Magazine,” or REM as we know it.

REM’s “About Us” section reads:

REM (Real Estate Magazine) is Canada’s premier monthly magazine for real estate professionals. REALTORS®, real estate agents, sales representatives, brokers, owners, administrators, and other real estate industry stakeholders read REM every month for news, analysis, and commentary on Canadian real estate.

REM is independently owned and operated, and is not affiliated with any real estate association or board.

But I would offer that REM isn’t only for real estate professionals. In fact, they often have some great content that the general public can benefit from.

Then again, it seems that a large portion of the general public is really only interested in articles that talk about house prices declining, regardless of the authenticity and accuracy of the stated facts.

It’s been a tough couple of days wading through the news, questions, and grandstanding politicians talking about “blind bidding.”

I don’t know if I can get into this today, honestly. It’s more than a Friday Rant, and it’s almost redundant at this point to talk about government legislation that has no impact, or worse – has unintended consequences.

Different news sources are going to provide different news. That’s been happening since the dawn of time. Look at Fox vs. CNN, for example. But this week, if you merely read the headlines (which many people do…) you would think “blind bidding” is over and done with, it was the sole cause of house price increases, it was driven by greedy Realtors who only make a commission on the portion of the sale “above asking,” and that the housing market is cooling to the point where everybody can own a home.

Right?

Maybe I’ll get into this on Monday. I’m undecided right now. I’m just so sick of misinformation, politics, and learned ignorance.

What I wanted to talk about today was an article that ran in REM earlier this week which touches on a conversation we’ve had here on TRB many times, as well as much of what the public debates on a regular basis: Who is making money off real estate?

Perhaps a second and more appropriate question is: Why is real estate so expensive?

I went on CTV Your Morning on Wednesday and was asked about the “changes to blind bidding,” and I made sure my first point was about all of the ways in whcih we’ve looked to blame someone or something for real estate prices. It’s foreign buyers. It’s low interest rates. It’s speculators. It’s flippers. It’s vacant homes. It’s taxation and development charges. And now, it’s the system, so let’s get down with early-2021’s hottest buzz word and ban “blind bidding.”

The point I wanted to make is that instead of accepting housing prices for what they are, many people need to find a culprit! Instead of accepting that the interaction of buyers and sellers in a free market, which results in a supply-and-demand surplus, balance, or deficit, is what determines pricing, many people want to “fix” a system or “solve” a problem.

This article in REM oh-so-eloquently shows us not only who profits from unaffordable housing but also why housing is expensive in the first place…

Who Profits Most From Unaffordable Housing?

By: Chris Seepe

April 18, 2022

Rental and purchase housing unaffordability will be the top-of-mind determining factor in our next provincial and federal elections.

The federal political parties are indistinguishable when reviewing their respective solutions. None understand the core fundamental causes of unaffordability, nor do provincial housing ministries and CMHC.

Who’s driving unaffordability?

All tenant advocates and most politicians and media blame the obvious culprits: landlords and investors. But who really benefits? Who stands to profit most from increased prices? Follow the money.

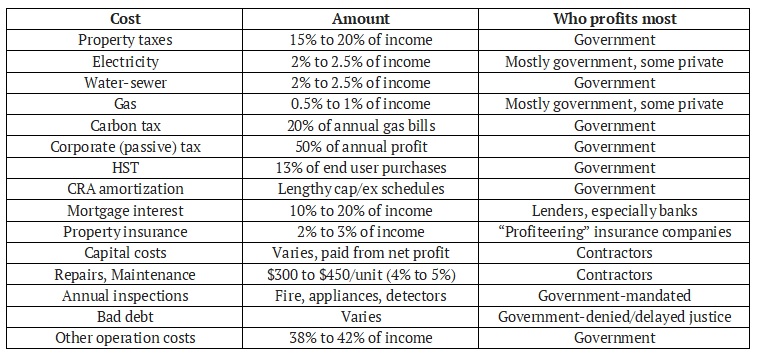

Ongoing operational costs include:

Notes: 33% of Toronto’s $11.8-billion revenue comes from property tax.

Missing middle housing corporate income tax is 50% while large operators (five or more employees) are taxed at around 13%

Maintenance costs of aging rental properties are between $300 and $450/unit but CMHC applies $850/unit, which substantially decreases property value and torpedoes many financing deals.

Ontario’s zero-percent 2020 annual rent increase wiped out $2.3 billion in rental housing equity used in part for property maintenance and upgrades.

A 2020 National Apartment Association survey reported that half of rental revenues are mortgage payments and property taxes and both of these are inflexible and must be paid to avoid powers of sale and foreclosures.

One-time costs include:

After a lifetime of servitude to providing rental housing, government siphons 25% of a property’s profit and demands that all depreciation previously taken must be repaid. The amount varies but can be 20% of profit from a sale.

Toronto’s land transfer tax doubles Ontario’s, which increased 560% since 1998.

Ontario was formed in 1867 but 87% of its net public debt accumulated since 1990. Ontario’s debt is higher than 168 countries including Russia and increased 1,000% in just 30 years.

First-time buyer incentives add more competition to ever-dwindling housing supply.

Other government- and lender-mandated costs include home inspection, property appraisal, title insurance, building insurance and condo reserve.

Other unaffordability costs and influences include land prices, land services (utilities, roads), supply chain choke points, construction material (increased two to four times in one year), construction labour and crime rate.

CMHC’s new Select points-based affordability program is based on the same antiquated and fatally flawed income-to-price ratio of the past 50 years that has ultimately led to Ontario losing 106,000 affordable rental housing units between 2020 and 2026 while Toronto eliminated 1,100 uninhabitable affordable units in 2019.

All political parties essentially proffer “tax the culprits,” supposedly to reduce demand. Taxes do nothing to dissuade investors and speculators, who aren’t the real culprits in any event. These taxes are added to the cost of doing business and simply passed on to the next buyers, thereby forever increasing unaffordability.

It’s no coincidence that the two Canadian provinces with the highest rental and purchase unaffordability rates are also the ones with the highest level of government interference in the housing industry: rent control, brutal anti-landlord and tenant-biased legislation, and a plethora of other disincentives to building new housing and upgrading existing housing.

The money trail of unaffordability leads straight back to the supposed steward of housing affordability.

Almost all government housing-related income and penalties are based on the value of property. The higher the property value and rent rates, the more income it generates for government. Not only is it a fundamental conflict of interest, but it’s also a paradox: government (and banks) cannot afford affordable housing.

If government harnessed its deflection and misdirection skills to addressing unaffordable housing or even simply stopped tampering with forces of which it has little knowledge and no control, the housing crisis would have been averted years ago.

As I said: call this biased if you want.

But is it wrong?

It’s opinionated. But is it wrong?

The money trail of unaffordability leads straight back to the supposed steward of housing affordability.

No kidding.

While I was busy being emailed “letters to the editor” this week from angry Ontarians who blame real estate agents and “blind bidding” for high real estate prices, the government was busy patting themselves on the back for their amazing “changes” to the Trust In Real Estate Services Act (TRESA).

Conservative MPP Ross Romano was quoted as saying:

“With these new protections, hard-working Ontarians can rest assured knowing that we have their backs!”

Could you possibly be more full of crap?

It’s like you walked into a room, had no clue who you were talking to, had no clue what was being discussed, and then simply puked political jargon.

Look at how many times the word “government” appears in those two charts above.

Look. Seriously. Scroll up again; do it for me.

I know that the contrarian opinion will shout, “David, this article was written for a real estate magazine!” But the content isn’t inaccurate, and the opinions shared therein, based on that content, can’t really be wrong.

I was going to save this for another day as well, but it fits so perfectly here: the City of Toronto raised development charges 49% last week.

Yes, you read that correctly; 49%.

And the best part?

This was only days after the federal Liberals announced a budget that focused on housing affordability.

As a TRB reader commented last week: “Take that, housing affordability!”

So folks, at the risk of being brief, I’ll end today’s post right here and now. We’ll talk about blind bidding and development charges next week. Unless, of course, y’all want to comment below…

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)