Renting vs. owning: The difference is ‘higher than at any time since the turn of the century’

[ad_1]

The housing marketplace may well be slowing down, but owning a residence is still a high-priced proposition. Two charts reveal exactly how expensive it is.

Just over a 12 months in the past, the regular value of owning and renting ended up almost similar, according to a web site submit from John Burns True Estate Consulting. “Now, proudly owning a home fees $839 much more for every month than renting. This differential is practically $200 larger than at any time considering the fact that the convert of the century,” Danielle Nguyen, senior analysis supervisor at John Burns wrote.

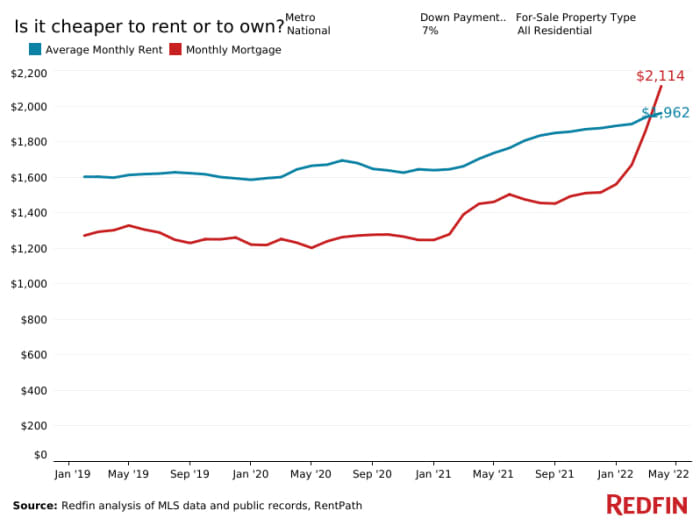

Throughout household qualities, leasing a residence would established one back again about $1,962 a thirty day period, in accordance to data from Redfin, as of April 2022. But if a property owner had set down a 7% down payment for a house, they’d be stuck with a house loan that would set them back $2,114 a month — $152 additional.

“With demand from customers now shifting towards leasing, dwelling builders who were as soon as hesitant to offer to rental house buyers are now soliciting features from buyers,” Nguyen extra. “Strong need from investors will present additional help to today’s household price ranges.”

The historical hole among owning and leasing can be witnessed in the chart underneath:

Hunting forward, nevertheless, Nguyen explained to MarketWatch, “High residence price ranges and growing interest charges may well impact house potential buyers.” Less folks can now qualify for households, she said. In truth, first-time buyers are increasingly priced out of the country’s hottest genuine-estate markets.

This homebuyer penalty hits harder in some spots in the country, in accordance to John Burns. In places where by home rates accelerated the most, like Raleigh-Durham, Nashville, Denver, Tampa, and Phoenix, owning a house was a great deal much more costly than renting.

John Burns Consulting assumed the purchase of a residence at 80% of the latest median price tag. They also believe that the purchaser set down a 5% down payment with a 30-calendar year set-price house loan.

To put that in context: A calendar year ago, renting would have established you back $1,705 a thirty day period, as in comparison to a month to month property finance loan payment of $1,451, the Countrywide Affiliation of Realtors said in a site submit in January.

The expense to individual a household went up because home charges have been soaring since the start of the COVID-19 pandemic, as men and women moved out of crowded cities assisted by their potential to do the job remotely. Increasing constructing expenditures and the lack of inventory also helped to drive up prices.

The normal value of a household as of May well 31 was just about $350,000, according to Zillow

Z,

In January 2020, correct right before the pandemic began to unfold throughout the country, the common dwelling was valued at $251,000.

In March 2022, the median property constitutes about 38.6% of an individual who is earning the median profits of $68,000 a 12 months, up from 30.2% in March 2021, in accordance to the Atlanta Federal Reserve.

Bought thoughts on the housing current market? Create to MarketWatch reporter Aarthi Swaminathan at [email protected].

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)