Rent Your Home Tax-Free With This Overlooked Tax Exception (Video)

[ad_1]

More and more Americans are turning to the rental property market to earn extra income. About 10.6 million people in the U.S are earning rental income in this manner. Of those, about 4 million people are using the property rental site Airbnb ( (ABNB) – Get Airbnb, Inc. Class A Report). How much are they making renting property? According to iProperty Management, the average Airbnb host earns about $9,600 annually.

The IRS does tax most rental property income, of course, there are tax deductions s for things like rental property depreciation. But, did you know that under the right circumstances, property-rental earnings can be tax-free? What are those conditions?

Watch the video above. TheStreet’s Robert Powell discusses that and more with Jeffrey Levine, CPA and nationally recognized thought-leader within the financial planning community.

Quotes| Rent Your Home Tax-Free With This Overlooked Tax Exception

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

Recommended Read: Tax Deductions for Rental Property Depreciation

Video Transcript:

Robert Powell: Welcome to TheStreet’s tax tips with Jeffrey Levine from Buckingham Wealth Partners. Jeffrey, when we talk about tax tips for 2022, many folks are renting out their home or parts of their home as an Airbnb. What do they need to know about recording their income and expenses?

Jeffrey Levine: Well, I think the first thing is, is this your primary residence, or is this a secondary residence, is this is a true rental property? If you’re using this as a true rental property, then you’re going to want to make sure that you file schedule E. You report all your income, your report all your expenses, generally, that will be on form schedule C where you will have that.

Recommended Read: Claiming Property Taxes on Your Tax Return

The same way as if you just simply rent it out to one individual for the entire year right, whether you do it in bits and bytes like an Airbnb type style or whether you do it simply I own this place and I rented it for the year doesn’t really matter. They’re all your improvements to the property or the things that you do to maintain it. Repairs and maintenance would be deductible, things you do to add value to the property that can be depreciated over time.

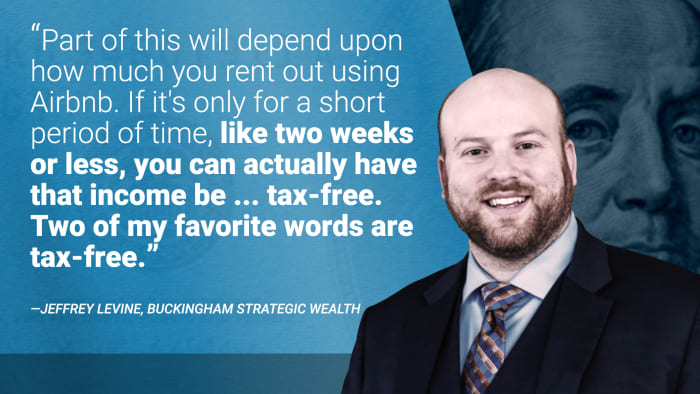

The other possibility, of course, is that this might be your house where you live most of the time. And if that’s the case then part of this will depend upon how much you rent out using Airbnb. If it’s only for a short period of time, like two weeks or less, you can actually have that income be, get this Bob, tax-free. Two of my favorite words are tax-free.

If it’s two weeks or less you’re going to be able to report that income tax-free, now no offsetting expenses. Right, you can’t deduct expenses against tax-free income, but you can have that be tax-free income. Now, to the extent that you actually rent out a portion of your house on an ongoing basis, then very much like you would if you had a separate residence or ar separate structure that you rented out, you would just kind of report the income and the expenses associated with that portion of your house. So, a portion of the electric, a portion of the water, etc., could be allocated against the rent that you receive for the apartment over your garage or something like that.

Robert Powell: Jeffrey, thanks for those tax tips, and we know that we have some more in store for our viewers in the weeks and months to come.

Jeffrey Levine: Well, I look forward to it and joining you and answering some more reader questions.

Editor’s note: Video produced by TheStreet’s Zach Faulds

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)