Minimizing the Capital-Gains Tax on Home Sale

[ad_1]

The big concern for long-time homeowners today is having to pay capital-gains tax on the net profit that’s ABOVE the exempted $500,000 for married couples. While the 2-out-of-5-year rule that was passed in 1997 is due for some adjusting, there haven’t been any indications that the politicians will re-visit the issue.

What can homeowners do to minimize the tax owed?

- Document Your Expenses. All home improvements (not repairs) and closing costs are added to your home’s cost basis (purchase price), which help to minimize the taxable gain.

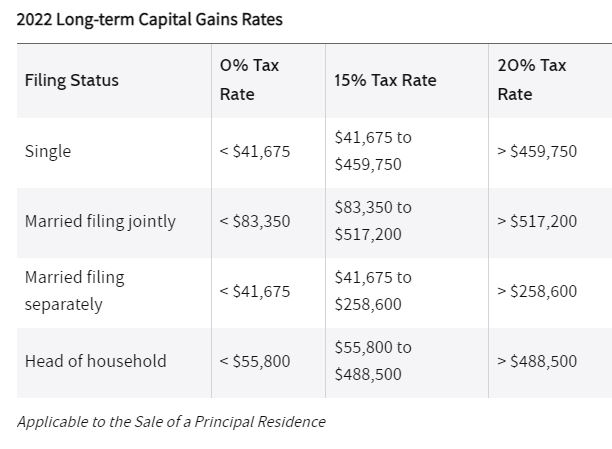

- Carry the Financing. Have a big equity position and don’t need all the money? Take payments from the buyer over time, instead of receiving all the cash at closing. Require a big down payment so you would receive a nice chunk up front, and then collect on a 5% mortgage over the next 5-10 years. You only pay tax on the money received, so structure it so you drop down into the 15% tax bracket for the first year:

- Rent it out for a year and do a 1031 Exchange. After renting your home out for a year, you could trade it for another rental property and postpone the capital-gains tax indefinitely. You have to rent out the new home too for at least a year before occupying as your residence, so it is a 2+ year project – but hey, no tax! If you don’t need to live there, another alternative is to buy a property in an ‘opportunity zone’. Investors begin to enjoy a step up in basis after 5 years. After 10 years, the gains become tax-free!

- Offset with capital losses from elsewhere. Business and stock losses can be included in the same tax return to offset the capital gains.

- Move every time your net gain rises up to $500,000. You may have to take a hit this time, but to avoid having to pay capital-gains tax again in the future, move more often. 🙂

- Dying correctly. The burden of being the remaining spouse after a full life together can be devastating, but at least he/she will have the cost basis increased to the home’s value on the day of death – with no capital-gains tax owed. Make sure to have your family trust named as owner of the home.

- Wait until your home’s value goes down. This isn’t likely to happen, so focus on 1-6 above!

Virtually every long-time homeowner has seen their equity rise enough in the last 12 months to cover their tax exposure, and didn’t that feel like free money? Instead of fretting over having to pay the government, just enjoy the ample amount left over – you made more than they did! Or utilize the tips above.

Check with your tax preparer for more details.

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)