Making Sense of the Multifamily Market Today – June 2022

[ad_1]

The multifamily industry these days is the strangest in my relatively small vocation (12 a long time). The range of likely financial results is huge, and I certainly deficiency the working experience to assess the effects inflation, fees, and a economic downturn may possibly have on the multifamily market place more than the near-phrase.

What’s fantastic about acquiring this outlet is that I get to write factors down and consider out loud, documenting my views and undertaking my best to make sense of the marketplace.

While admittedly I’m not sure what’s going to occur, the over-utilised adage rings genuine – though record may not repeat alone, it does rhyme.

Let us crack items down into a pair diverse segments inflation/charges, single-spouse and children housing, offer/need fundamentals, and concerns/issues to check out.

Inflation / Charges

Genuine estate, and multifamily in certain, is a excellent inflation hedge. Rents reset each day, and leases commonly roll each and every 12 months. Hire advancement at our current houses have far outpaced inflation.

While inflation fears are higher nowadays, the consensus is that it will be tamed, but at what value?

Presented inflation is a fairly short-expression challenge, the market is reacting more acutely to the increase in interest costs. The surge in borrowing expenditures have pushed up cap premiums and introduced the cash marketplaces to a momentary freeze. This has been most notable on worth-insert specials exactly where buyer’s commonly place on superior leverage.

I expect costs to continue being high, but normalize and occur back down as recession fears set in. Spreads really should also stabilize as we get far more clarity on the current market direction.

One-Relatives Housing

The solitary-household housing sector is terribly harmful right now. Logan Mohtashami from HousingWire has the some of the clearest housing assessment which goes like this (dependent mostly on this article):

- The operate up in housing costs in excess of the earlier 2 years has been pushed mostly by stock becoming at all-moments lows at a time when housing demographics have been unbelievably robust.

- Inventory has been steadily slipping considering that 2014 and is in an harmful posture today. Traditionally stock levels are between 2 million and 2.5 million. We started off 2022 at just 870,000 residences for sale.

- A task-loss recession would be required to produce any type of distress. Having said that, the buyer is in a potent fiscal placement these days.

- Greater prices will gradual housing need and we’re presently viewing purchase apps slowing, but it is going to just take a although for stock stages to enhance significantly.

Unaffordable housing is a boon for multifamily demand in the brief-time period, but in excess of the very long-term bigger fees will slow housing desire and average pricing, consequently making single-household housing extra affordable.

The Renter

American individuals reman in superior fiscal well being owing to the blend of a solid labor current market, wage expansion, low leverage, and run up in housing prices and the inventory marketplace.

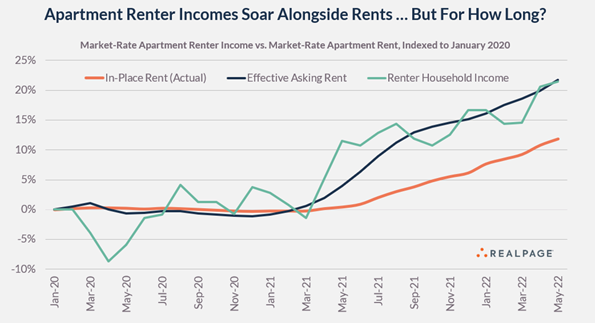

A single of the largest drivers and one particular of the biggest dilemma marks today is what comes about to renter home incomes goin forward. When I wrote about the SE multifamily current market back again in January, I questioned ‘are rents outpacing wages in these markets to these kinds of an increase that there are not sufficient substantial-paying employment to assistance them?’

That continues to be the most significant query about the multifamily sector nowadays. Incomes and rents are closely corelated. As charges carry on to surge, most notably payroll, coverage, utilities, R&M, and taxes, there remains pressure to drive rents.

If wage advancement stagnates, we’ll see far more doubling up, lower retention, and a reduction in new lease need. See the chart under from Jay Parsons of RealPage demonstrating the limited correlation between incomes and rents.

Multifamily Offer/Desire

Demand from customers

The multifamily fundamentals continue to be potent. Career advancement and wage expansion are the two anticipated to keep on being healthy. In addition, the uncoupling of young grown ups from moms and dads and roommates will proceed to profit near time period need. Even so, the demographics soften as the 25–34-12 months-old cohort grows at <0.5% per year over the next 3 years, then declines starting in 2025 (Green Street).

Additionally, the recent rise in rates and the likely impending recession may lead to hiring freezes and layoffs in certain sectors, resulting in slower than expected job growth.

Revenue growth will continue to be strong due to mark-to-market of the rent roll (especially in the Sunbelt) but will likely slow due to deteriorating macroeconomic conditions.

Supply

On the supply side, development delays have helped insulate apartment fundamentals. However, supply will grow over the coming years as the units under construction eventually deliver and the starts/permits continue to accelerate.

Tightening credit markets and rising construction costs may restrain supply in the short-term, but rising rents (and attractive profit margins) will keep a floor under starts.

Supply will vary by market with the Sunbelt markets seeing accelerating supply growth over the next 2-3 years. There are no absorption issues today, and broad-based excesses in supply are unlikely in the near-term given the strong demand, but select markets are heading for over-supply.

Questions/Things to Watch

- Are we heading for a recession and if so, how severe will it be?

- Will the labor market remain tight and will wage growth continue?

- Will supply catch up to demand and are select markets over-supplied?

- Are rents outpacing wage growth, leading to expanding rent-to-income ratios?

- Will rates normalize then begin to decline as recession fears set it?

- When will supply-chain issues taper and will construction costs come back down any time soon?

While this is my attempt of making sense of today’s market, I remain focused on buying and building multifamily assets to hold long-term in markets with strong fundamentals.

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)