Apartment REITs: Roaring Rents And Record Inflation

[ad_1]

MarkHatfield/iStock via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on May 4th.

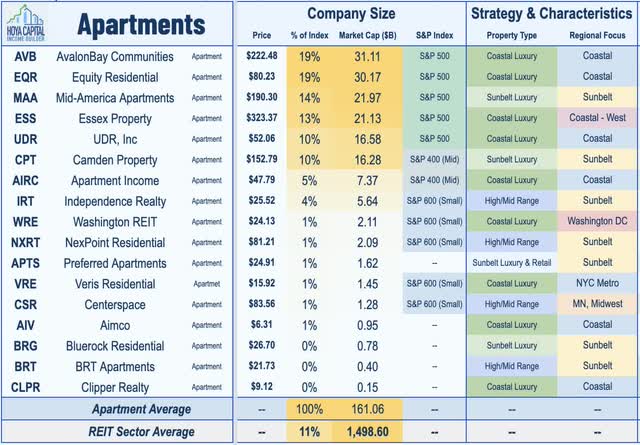

REIT Rankings: Apartments

Hoya Capital

Rents are soaring at the fastest pace on record in essentially every major market across the country with no signs of slowing anytime. Riding the rental boom, Apartment REITs continue to report stellar earnings results with record-setting rent growth while simultaneously managing to increase occupancy rates to record-highs and reduce turnover rates to record-lows. Within the Hoya Capital Apartment REIT Index, we track the seventeen largest apartment REITs which collectively account for roughly $160B in market value, $300B in total asset value, and own over a million rental units across the United States.

Hoya Capital

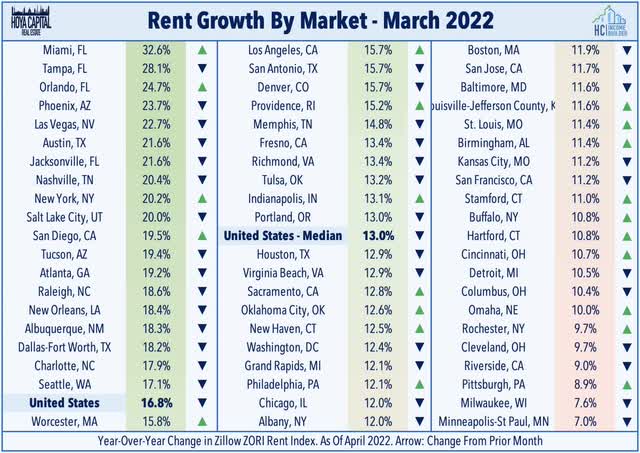

An unwelcome surprise is awaiting millions of renters across the country at the end of their coming lease term, most of which will see a double-digit percentage increase on their renewal offer. Good luck finding a better deal in the open market, as the era of “free rent” and other concessions are long gone and units don’t sit vacant for longer than a few weeks. In its rent report, Zumper’s reported that rent growth accelerated to nearly 15% in April while noting that rents through the first four months of 2022 are rising at almost twice the rate as the same period in 2021, providing evidence that the “astonishing rent growth may be the norm for the foreseeable future.” Meanwhile, Zillow (Z) recorded a record-setting 16.8% increase in rents in its most recent report with 54 of the top 60 markets seeing rent growth in excess of 10% and ten markets seeing annual rent growth in excess of 20%.

Hoya Capital

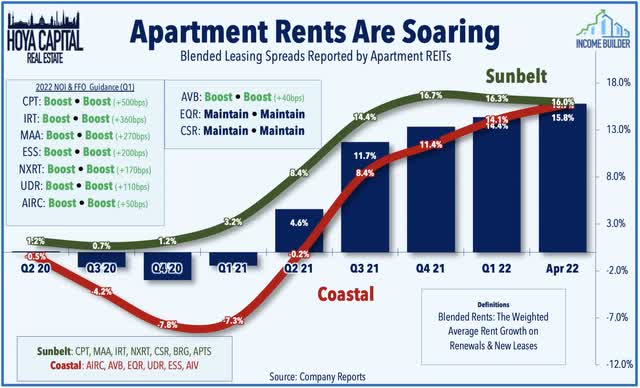

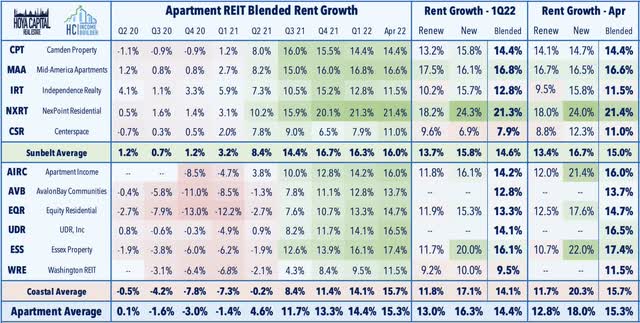

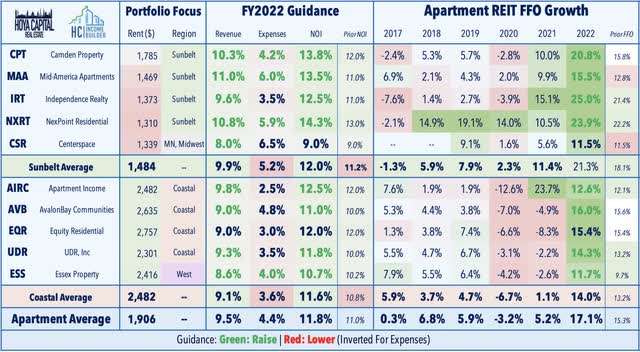

As discussed in our REIT Earnings Halftime Report, earnings results across the sector have been extremely impressive, indicating that higher mortgage rates have simply shifted the robust housing demand from the ownership market back towards the rental markets while supply growth has been insufficient to meet the robust demand. Upside standouts included Sunbelt-focused Camden Property (CPT) which raised its full-year FFO growth outlook by 500 basis points to 20.8%, Independence Realty (IRT), which boosted its outlook by 360 basis points to 25.0%, and Mid-America (MAA) which raised its FFO outlook by 270 basis points to 15.5%. NexPoint Residential (NXRT), meanwhile, also hiked its full-year outlook and recorded the strongest rent growth on new leases ever recorded in the apartment REIT sector at 24.3%.

Hoya Capital

Nine of the eleven major apartment REITs raised their full-year FFO and NOI outlooks with sector-wide FFO growth now expected to average 17.1% this year – up 180 basis points from the midpoint of last quarter’s guidance. Aside from the stellar apartment REIT results, West-Coast focused Essex (ESS) also reported impressive results, highlighted by 20.0% spreads on new leases in Q1, which accelerated further to 22.0% in April while Apartment Income (AIRC) also delivered a solid upside surprise. Results from Equity Residential (EQR) and AvalonBay (AVB) were solid but less spectacular as strong leasing results were offset by an uptick in delinquency rates in its California market related to the delayed implementation of the state’s rental assistance program.

Hoya Capital

Simply looking at the blended lease rates doesn’t quite do justice to the history we’re observing in the residential rental markets as residential REITs have actually exhibited restraint in rental rate increases on existing tenants with many renewal offers this year issued at slightly below-market rents, in part to avoid regulatory issues related to the magnitude of rent increases. Rent growth on new leases climbed to 16% in Q1 and accelerated further to 18% in April with three REITs – NexPoint (NXRT), Apartment Income (AIRC), and Essex (ESS) all breaching the 20% threshold in April.

Hoya Capital

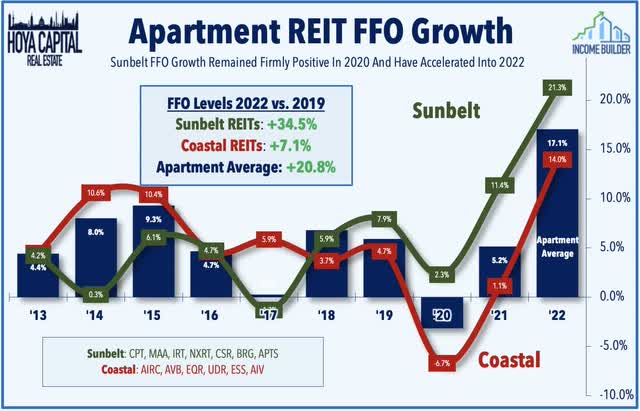

It’s shaping up to be the strongest year ever for apartment REITs with ten of the eleven REITs now expecting same-store NOI growth in excess of 10% while all eleven REITs expect double-digit FFO growth. While there are some pandemic-related “catch-up” effects at play with several of the coastal REITs which recorded a 5-10% decline in FFO in 2020, Sunbelt REITs never skipped a beat during the pandemic. Sunbelt REITs now expect 2022 FFO levels to be 34.5% above their pre-pandemic rate from 2019 while Coastal REITs expect 2022 FFO levels to be 7.1% above 2019-levels.

Hoya Capital

Deeper Dive: Apartment REIT Portfolios

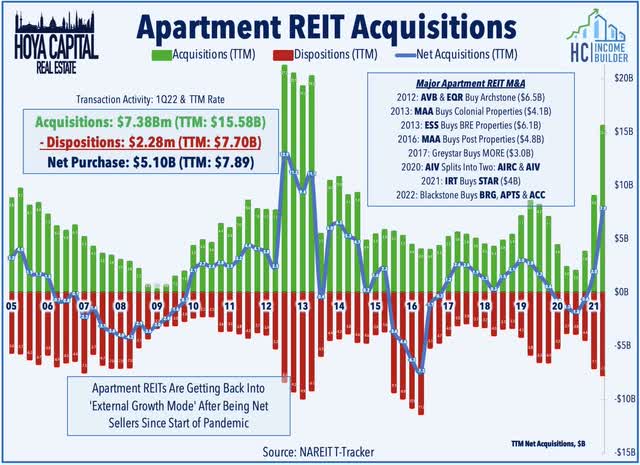

Stellar fundamentals have reignited the animal spirits across the apartment REIT sector as well, underscoring the strong appetite in the private markets for high-quality apartment assets. Blackstone (BX) has picked off a trio of multifamily REITs over the past six months for its nontraded REIT, Blackstone Real Estate Income Trust (“BREIT”). Last December, Blackstone agreed to acquire Bluerock Residential Growth REIT (BRG) in an all-cash transaction valuing the REIT at $3.6 billion at $24.25/share – a roughly 80% premium from its pre-announcement share price. Two months later, Blackstone agreed to acquire Preferred Apartment Communities (APTS) in a $5.8B deal at $25 /share – a 40% premium from its pre-announcement price and then in April, Blackstone acquired student housing REIT American Campus (ACC) in a $12.8 billion takeout at $65.47/share bid – a 14% premium to ACC’s prior close.

Hoya Capital

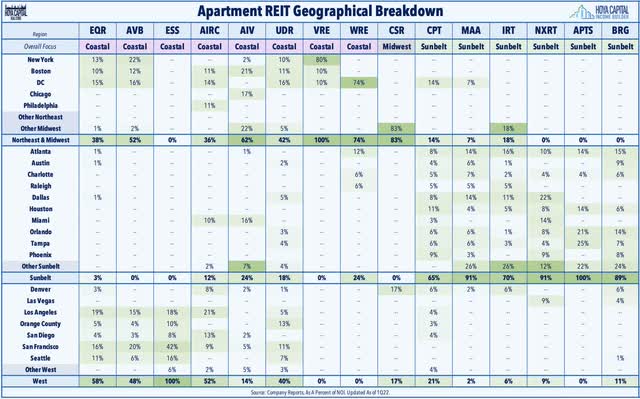

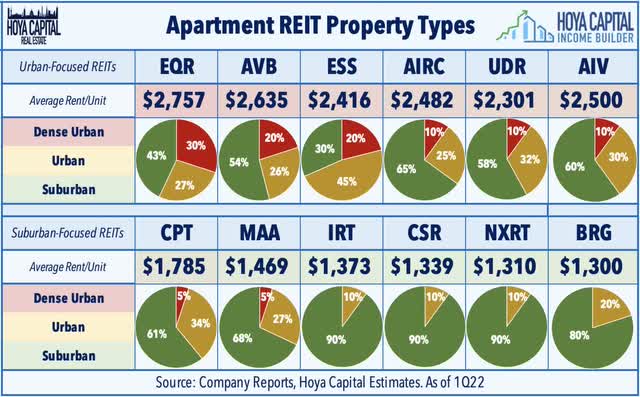

As a sector, apartment REITs collectively have fairly balanced geographical exposure across most of the major U.S. markets. Individual apartment REITs tend to focus on either coastal markets or sunbelt and secondary markets and own portfolios that typically include a blend of luxury high-rise, mid-rise, and garden-style apartment communities. Coastal apartment REITs include Equity Residential (EQR), AvalonBay (AVB), Essex, Apartment Income, UDR (UDR), and AIMCO (AIV), while sunbelt-focused apartment REITs include Camden, Mid-America, Independence, Centerspace (CSR), and NexPoint Residential. We’ve also seen a pair of office REITs shift their focus to become pure-play multifamily REITs over the last year: Washington REIT (WRE), and Veris Residential (VRE) – formerly Mack-Cali.

Hoya Capital

Perhaps even more important than their geographical distribution, the distribution of portfolios towards either urban or suburban has taken on added significance during the pandemic as suburban properties surrounding the hardest-hit “shutdown cities” have seen some of the strongest rates of rent growth both in the multifamily and single-family rental categories. For example, NYC suburbs Stamford and New Haven, Connecticut are seeing their strongest rates of rent growth since at least 2015 as flexible remote work options have lessened the burden of the longer suburban commutes.

Hoya Capital

Deeper Dive: Apartment Industry Dynamics

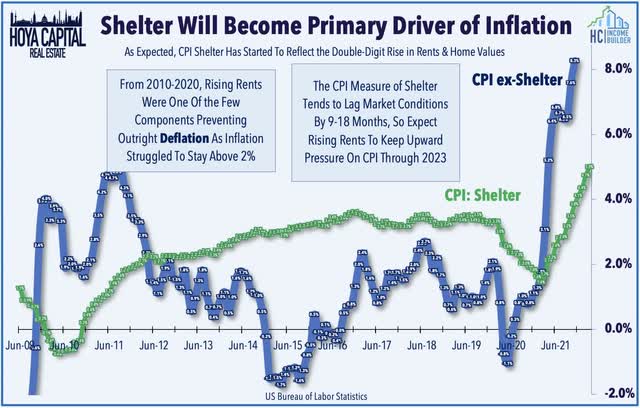

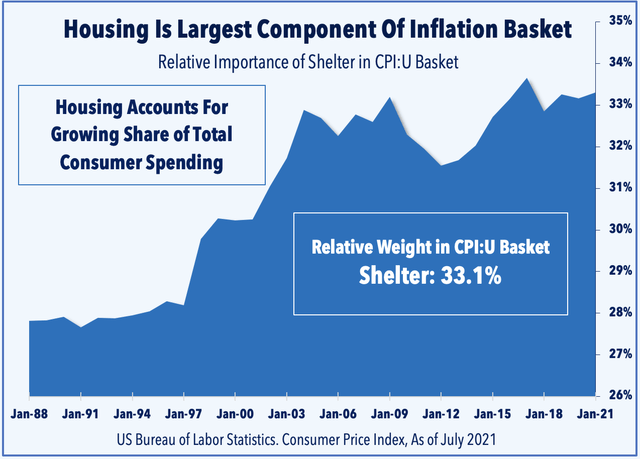

Taking a step back to a more macro-level, while goods shortages and the resulting inflation should gradually ease over the next year as the world emerges from the pandemic, the housing shortage will likely persist into the back half of the decade, and shelter costs will resume their role as the primary driver of inflation. We’ve discussed for many months how the historic surge in rents has not yet been captured by the BLS inflation metrics which showed rent inflation of just 5.0% last month. We expect that as these effects begin to filter into the data, shelter will again become the primary driver of inflation, as was the case for much of the post-GFC period through 2020.

Hoya Capital

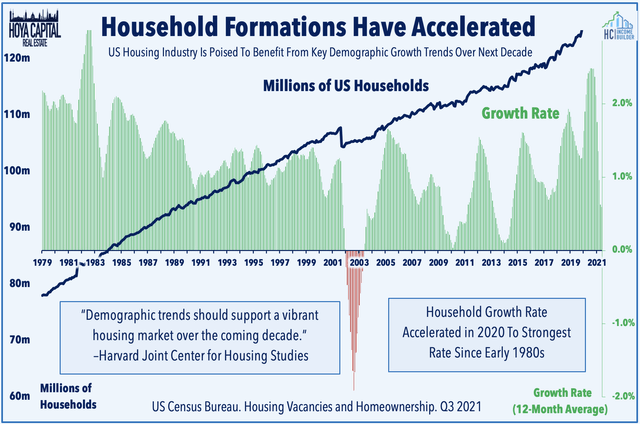

As we’ve discussed at length over the past decade, demographics suggested the 2020s were already poised to see historic levels of housing demand as the millennial generation – the largest cohort in American history – comes full-steam into a severely undersupplied U.S. housing market. What we could not foresee, however, was the added acceleration provided by the pandemic-driven “Work From Home era” which has begun to unleash millions of extra “deferred” formations among adult children, in particular. Additionally, stronger-than-expected household formations trends are consistent with our long-held theory that population estimates and – and thus U.S. population growth – have been materially understated by Federal statistical agencies over the past several administrations due primarily to the undercounting of immigrant populations, an undercount that the Census Bureau confirmed in a report last month.

Hoya Capital

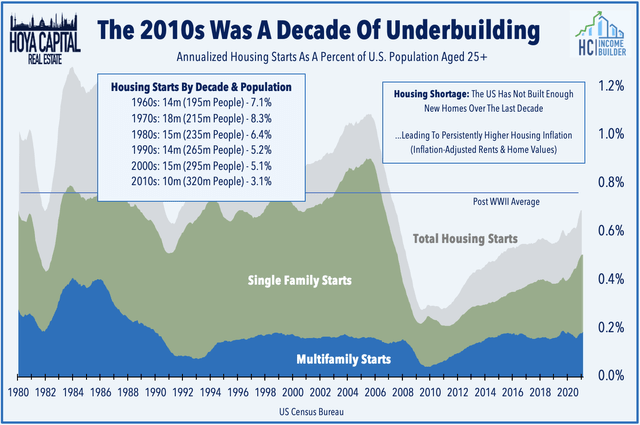

For the undersupplied housing industry, we expect the favorable supply/demand imbalance to persist for the foreseeable future amid ongoing constraints on new home construction while demographic-driven and WFH-driven demand remain resilient. Freddie Mac estimates that the U.S. housing market is 3.8 million homes short of what’s needed to meet the country’s demand, representing a 52% rise in the nation’s housing shortage compared with 2018. The record-low inventory levels of homes have resulted in rent growth and home price appreciation persistently above the rate of inflation throughout the past decade – a very positive fundamental backdrop not only for apartment REITs, but across the broader U.S. housing industry.

Hoya Capital

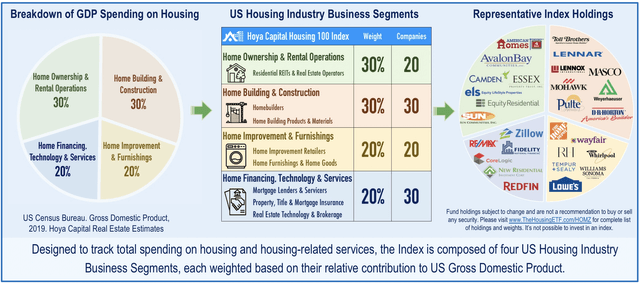

As goes the U.S. housing industry, so goes the U.S. economy. The $4-5 trillion U.S. multifamily apartment market is highly fragmented, with these seventeen REITs owning roughly 1,000,000 of the estimated 25 million multifamily rental units across the US, which is only about 2-4% of the total rental apartment stock. Multifamily rental units comprise roughly 15% of all housing units in the United States, and these apartment REITs comprise roughly 15% of the Hoya Capital Housing Index, the housing industry benchmark that tracks the performance of the U.S. housing sector. Importantly, residential real estate has proven to be one of the best inflation hedging assets over the last century not only in the U.S. but also across different regions.

Hoya Capital

Apartment REIT Stock Performance

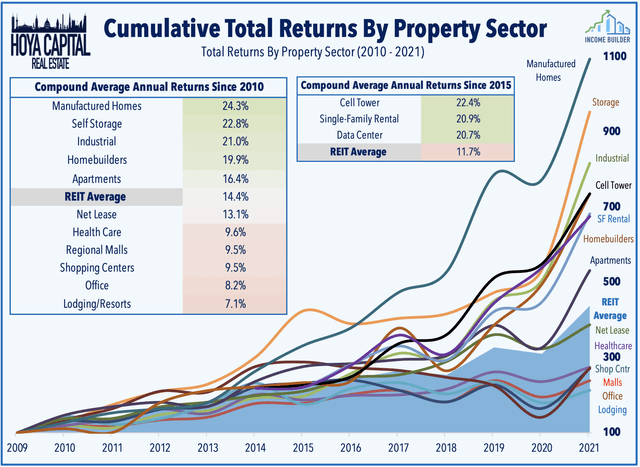

Apartment REITs – which were slammed early in the pandemic amid concern over missed rents – rebounded in 2021 with their second-strongest year on record, producing total returns of 58% with widespread strength across both Sunbelt-focused and Coastal-focused REITs. Apartment REITs have been some of the strongest-performing REITs over most long-term measurement periods. From 2010 through 2021, Apartment REITs have delivered average annual returns of 16.4%, outpacing the 14.4% annual total returns from the broad-based REIT average during that time.

Hoya Capital

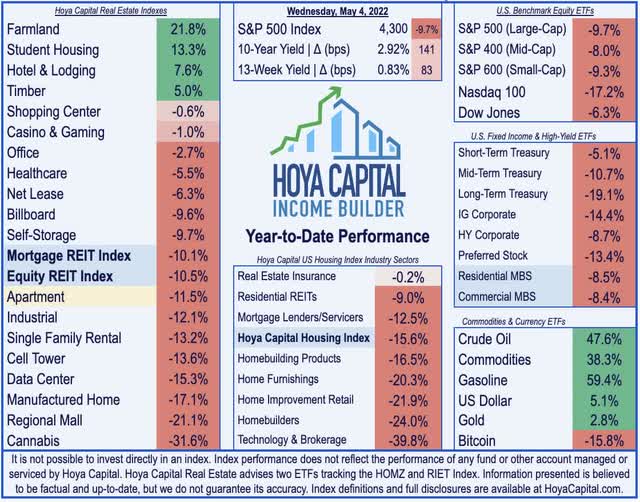

Despite the stellar earnings results and soaring rent growth, apartment REITs have been pressured this year from the growth-to-value rotation within the real estate sector this year as many of the “COVID winners” have been laggards this year. Apartment REITs are lower by 11.5% this year, lagging the 10.5% decline from the broad-based Vanguard Real Estate ETF (VNQ) and the 9.7% decline from the S&P 500 ETF (SPY). Just four REIT sectors are in positive territory for the year, and notably, apartment REITs have delivered stronger performance compared to their residential REIT peers – manufactured housing and single-family rental REITs.

Hoya Capital

Apartment REIT External Growth

The “animal spirits” have come alive across the REIT universe, and apartment REITs are showing early signs of getting back into external growth mode which we expect could add several percentage points of FFO growth in the years ahead if REIT valuations remain healthy and elevated. While the official total from NAREIT is not yet released for the first quarter, Q4 saw a robust level of acquisition activity in which REITs acquired more assets than in any quarter since late 2019. Underscoring the swelling appetite for external growth, last quarter AVB commented, “we have shifted to offense.”

Hoya Capital

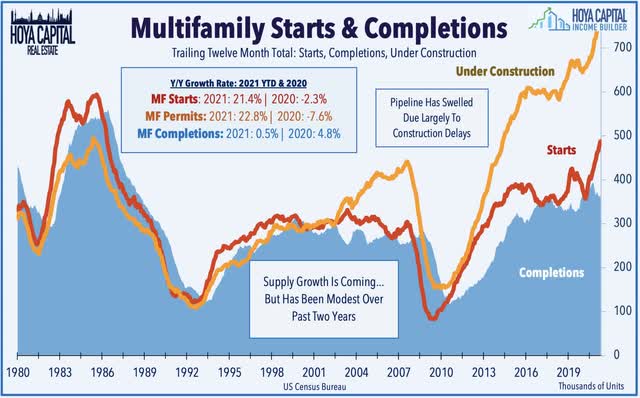

These apartment REITs are as active as ever on the development front and while overall supply growth has been modest over the past two years, it is set to rebound as robust fundamentals pulled developers back into the game and as construction delays begin to ease. Supply growth has been kept in check nationwide over the last few years from these bottlenecks as the quantity of completions rose just 0.5% in 2021 after a modest rise of 4.8% in 2020, but with the pipeline as large as it’s ever been, we do expect to see an increased level of new supply over the next few years.

Hoya Capital

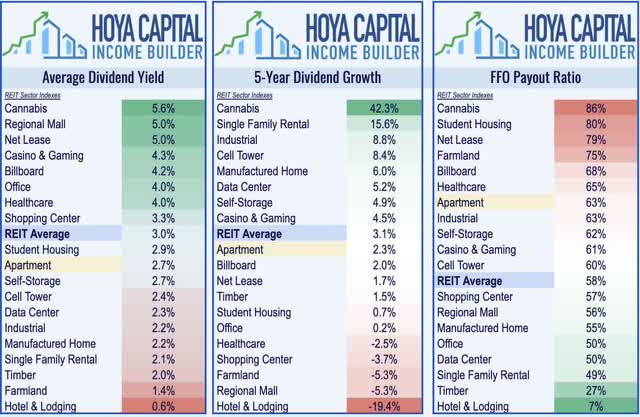

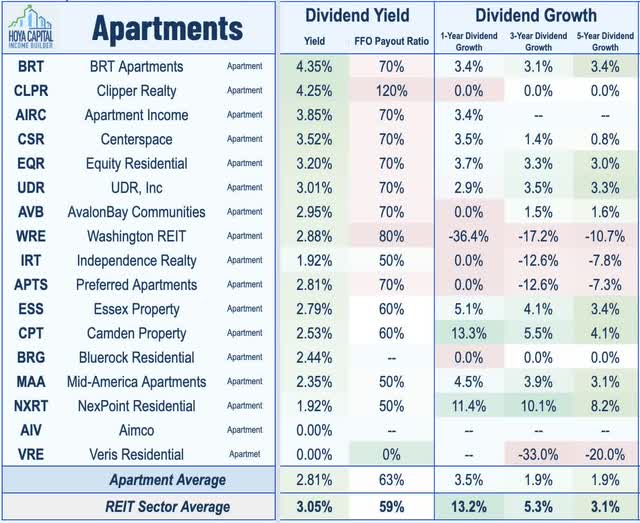

Apartment REIT Dividend Yields

Apartment REITs pay an average dividend yield of 2.8%, which is slightly below the REIT market-cap-weighted sector average of 3.0%. Since the start of 2015, apartment REITs have delivered average annual dividend growth of roughly 2.5%, which is roughly in-line with the REIT average. Apartment REITs pay out only around 65% of their available cash flow, giving these companies the flexibility to take advantage of external growth opportunities or to increase distributions.

Hoya Capital

Near-perfect rent collection throughout the pandemic allowed apartment REITs to not only avoid the wave of dividend cuts that swept through the REIT sector during the early stages of the pandemic but to also actually be among few REITs to raise their distributions last year. Nine apartment REITs raised their dividend last year with NexPoint delivering the strongest rate of increase. The ten larger and lower-leverage REITs pay dividend yields ranging from 2.25% to 3.85%, while the small-cap REITs pay yields up to around 4.4%.

Hoya Capital

Takeaway: Shelter From Inflation

While broader inflationary pressures should begin to ease amid a slowdown in global economic growth, shelter inflation will remain persistent given the lingering housing shortage resulting from a decade of underbuilding. Higher mortgage rates have simply shifted the robust housing demand from the ownership market back towards the rental markets while supply growth has been insufficient to meet the robust demand. We remain bullish on the apartment REIT sector, which we see as one of the better inflation hedges across any asset class and as a continued beneficiary of the ongoing housing shortage and resulting upward pressure on rent growth.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

[ad_2]

Source link

:max_bytes(150000):strip_icc()/GettyImages-559025517-2000-b3bece30a9074ec3958a4d39f69f2a79.jpg)